This article has been just updated: January 18, 2024

Since 1998, PayPal has been making it easier for people around the world to purchase goods and services online, send money to friends and family, and take advantage of the numerous work opportunities created by the internet.

But despite its enormous popularity, PayPal is far from perfect, and many users are dissatisfied with its seller protection policies, large fees for chargebacks, or poor customer service, just to give a few examples.

Fortunately, there are plenty of excellent PayPal alternatives in December 2024, many of which have lower fees, are easier to set up and use, and have customer support that cares.

Best PayPal Alternatives in December 2024

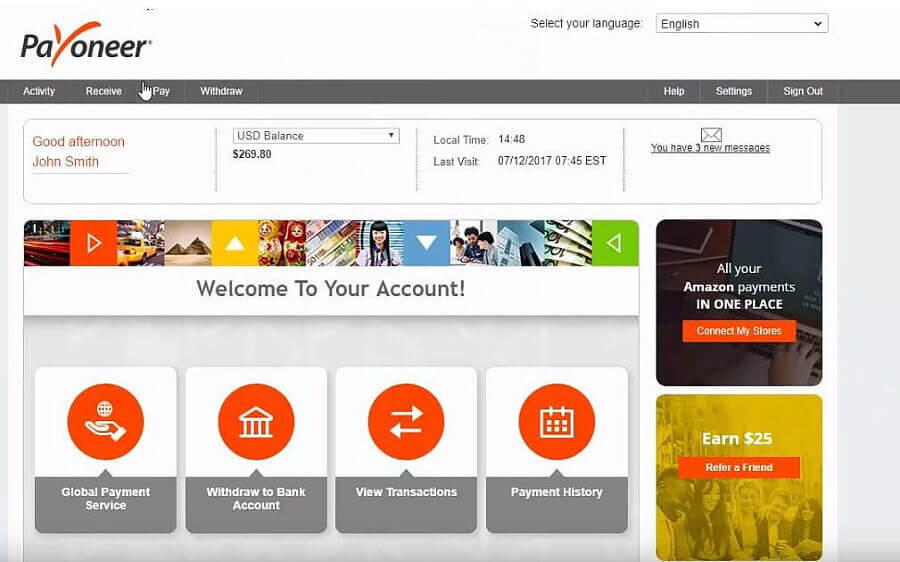

1. Payoneer

Named as CNBC’s 13th most disruptive company in 2024, Payoner is arguably the best alternative to PayPal in December 2024. It was founded in 2005 by Yuval Tai, who served in the Israeli Defense Forces as a special operations commander before earning an M.Sc. in biomedical engineering from Tel Aviv University in Israel.

Payoneer’s goal is to empower businesses, online sellers, and freelancers around the world with a cross-border payments platform that allows them to get paid globally as easily as they do locally. So far, Payoneer has established partnerships with Airbnb, Amazon, Google, Upwork, Rakuten, Walmart, Wish.com, Fiverr, Envato, and several other prominent internet companies.

All Payoneer users get an international receiving account in the currency of their choice (USD, EUR, GBP, JPY, AUD, CAD, MXN, and more), and they can use this account just like a regular bank account. Customers, business partners, and anyone else can send money via a local bank transfer directly to the receiving account, making the process extremely simple for both parties.

To withdraw money, you can either tell Payoneer to transfer your funds to your local bank account or use Payoneer’s debit card to withdraw money from any ATM. Payoneer charges an annual fee of $29.95 for its debit card, but you can also skip it and use your Payoneer account without it for free.

Receiving payments from another Payoneer customer is always free, but there’s a 3% fee for accepting credit card payments directly from clients. All fees are clearly explained on Payoneer’s website, so you’ll always know exactly how much you can expect to pay or earn.

How to create a Payoneer account:

- Go to: https://www.payoneer.com/

- Click “Register.”

- Provider your personal details.

- Decide if you want to apply for a Payoneer Prepaid MasterCard.

- Wait for Payoneer to review your application.

2. Bitcoin

Anyone who hasn’t been living under a rock for the last decade has at least heard of Bitcoin, the first cryptocurrency in the world. Released by an unknown developer who goes under the name Satoshi Nakamoto in 2009, Bitcoin change the world by providing a decentralized alternative to established payment methods.

Instead of being controlled by a single organization or bank, Bitcoin is completely decentralized and developed as open-source software. As such, it’s virtually impossible to take it down or disrupt its operation, making it a great PayPal alternative in December 2024 for anyone who’s afraid of losing access to funds, which is something that many PayPal users have experienced in the past, as evident from user reviews on Trustpilot.

In addition to its resilient nature, Bitcoin offers very low transaction fees, quick payments, global reach, and excellent privacy protection. In fact, you’re not even required to disclose your real name to use Bitcoin.

There are some downsides to using Bitcoin as a PayPal alternative, however. To start with, Bitcoin is susceptible to high price volatility, so a payment of $1,000 could be worth just $800 by the end of the same week or even day. Since there’s no central authority watching over Bitcoin users, there’s also nobody to contact when you make a mistake and send your money to someone else or when you become a victim of a scam or fraud.

To start accepting Bitcoin payments, you need a Bitcoin wallet, and this is how to create one:

- Choose a wallet.

- This website can help you find the right Bitcoin wallet for you: https://bitcoin.org/en/choose-your-wallet

- Download and install the wallet.

- Launch the wallet and find your Bitcoin address, an identifier of 26-35 alphanumeric characters.

- Include your Bitcoin address when requesting payments from clients.

- (Optional) Exchange your bitcoins for other currencies on a Bitcoin exchange.

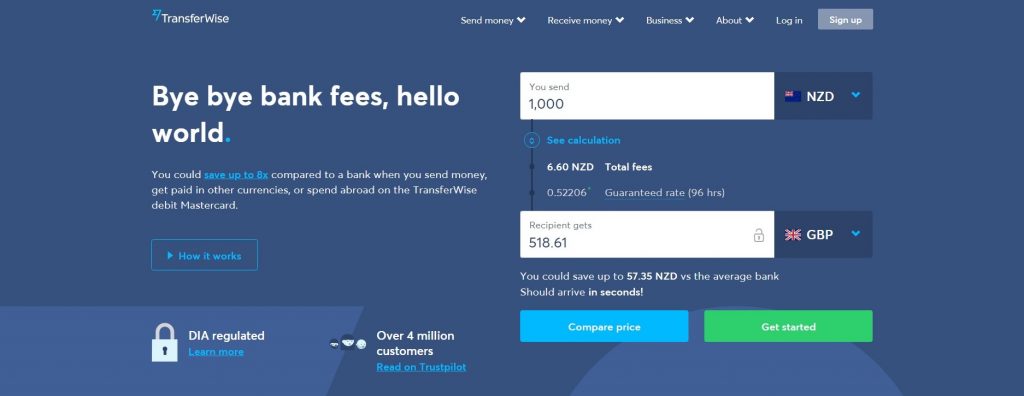

3. TransferWise

Founded in 2011 by Estonians Kristo Käärmann and Taavet Hinrikus, TransferWise is a London-based online money transfer service whose current customer base is around 6 million people, according to its annual report.

TransferWise wouldn’t be known as one of the cheapest alternatives to PayPal if it wasn’t for its ingenious transfer-matching process, which avoids currency conversion and transfers crossing borders.

The way it works is simple: when you decide to send funds across the border to a person who has a bank account in a different currency, TransferWise finds someone who wants to make a similar transaction but the other way around and uses these pools of funds to pay out transfers via local bank transfer.

TransferWise has revamped its fee structure several times since it launched, and the total fee is now a decreasing percentage of the amount to be transferred. You can easily calculate your TransferWise transfer cost using the handy fee calculator. Simply enter how much you want to send and in which currency, and the calculator will instantly spit out how much it would cost to send money from your debit or credit card as well as from your bank account, which is the cheaper option.

In 2017, TransferWise launched its borderless account, allowing users to spend their money anywhere in the world with a TransferWise debit MasterCard. With the borderless account, you’ll get an Australian account number and BSB code, a British account number and sort code, a European IBAN, and a US account number and routing number.

How to create a TransferWise account:

- Go to: https://transferwise.com

- Click “Register.”

- Create either a personal or business account.

- Enter your personal information.

- Verify your identity.

4. Stripe

If you have an online business, Stripe might just be the best PayPal alternative for you in December 2024. You can think of Stripe as a comprehensive platform that allows users to accept credit card payments on their apps and websites. It was founded in 2010 by Irish entrepreneurs John and Patrick Collison and launched publicly a year later.

As a cloud-based payment platform, Stripe is virtually infinitely scalable, and its security is in the hands of experienced professionals—not individual users. Sitting on top of Stripe’s payment platform are applications to manage revenue, prevent fraud, and expand internationally.

Stripe can be easily integrated with leading e-commerce platforms, such as WordPress and Shopify, but it also works with custom e-commerce solutions. Its extensive documentation covers everything developers need to know to quickly build custom integrations.

Stripe charges a fee of 2.9% + 30 cents for access to its complete payments platform, which includes everything online businesses need to manage payments, such as embeddable checkout page, custom UI toolkit, simplified PCI compliance, invoice support, secure payment info collection, real-time reporting, 24×7 support, and more.

Businesses that process a large volume of payments or rely on a unique business model can contact Stripe’s sales team to get volume and multi-product discounts. Stripe also has an easy-to-use platform for forming a company, called Stripe Atlas.

With Stripe Atlas, anyone can form a company in Delaware and receive a tax ID number from the IRS in just a few days for just $500. All you need to do is create an application, submit the necessary information, and Stripe will take care of the rest.

How to create a Stripe account:

- Go to: https://stripe.com/

- Click the “Sign in” option.

- At the bottom of the sign-in page, select “Sign up.”

- Enter your email address, full name, and password.

- Open the confirmation email.

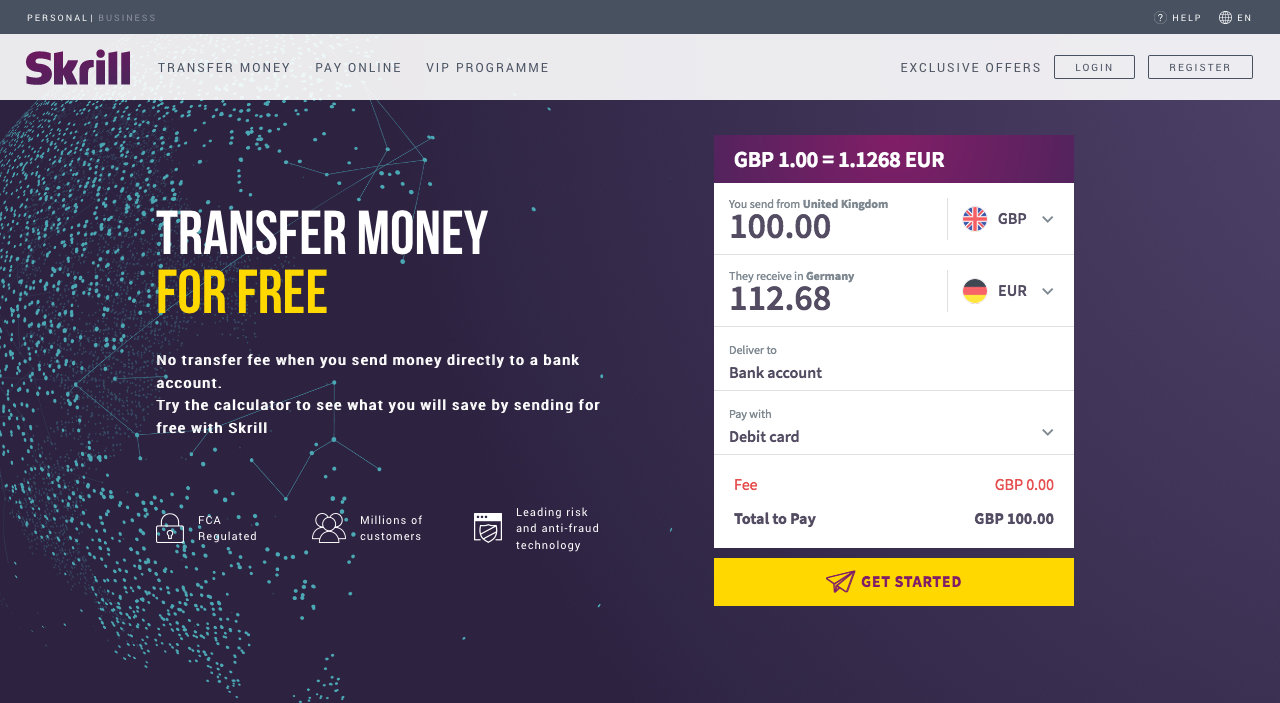

5. Skrill

Skrill is an online payment service that positions itself as a low-cost alternative to PayPal that actually cares about its users. The company is headquartered in the United Kingdom, and it now serves over 40 million users across 200 countries.

Before 2011, Skrill was known as Moneybookers, but its owners wanted a name that could be used as a verb for online payments (just like the word google is now used as a synonym for any form of online searching).

Skrill allows its users to easily send money home or abroad— directly to a bank account, to another Skrill wallet, or a mobile wallet. Online merchants can take advantage of Skrill’s wire transfer service, which allows customers to make lightning-fast transactions with their online banking details.

Unlike PayPal, Skrill lets its users buy and sell Bitcoin and other cryptocurrencies, making it one of the most progressive online payment services in the world. However, not all payment methods are available in all regions.

To find out which payment methods are available in your regions and learn everything you need to know about Skrill’s fees, visit this page and select your country and currency.

Skill users have the option to join its VIP club to gain access to 24/7 support, special promotions, and other important perks. The VIP club is accessible only to merchants who transact $15,000 or more in a quarter.

How to create a Skrill account:

- Go to: https://www.skrill.com/

- Choose your language.

- Click “Register.”

- Enter your full name, country, currency, email, and password.

- Confirm your account.

FAQ

What are some of the top alternatives to PayPal that existed in December 2024?

Stripe, Square, Skrill, Payoneer, and TransferWise (now known as Wise) were among the top PayPal alternatives in December 2024. Each platform offered unique features catering to different types of businesses and individuals.

How did Stripe compare to PayPal?

Stripe was favored by developers for its flexible API and focus on e-commerce integration. It allowed for more customization compared to PayPal and provided better tools for managing online businesses.

Could Square be used by individuals or was it solely for businesses?

Square was mainly geared towards businesses, offering tools for point-of-sale transactions, inventory management, and analytics. However, individuals could use Square Cash (now known as Cash App) for peer-to-peer payments.

What were the benefits of using Skrill instead of PayPal?

Skrill offered benefits such as a prepaid debit card and the ability to transact in cryptocurrencies, which set it apart from PayPal. It was also known for its straightforward fee structure and focus on international transactions.

How did Payoneer position itself as a PayPal alternative?

Payoneer focused on providing cross-border payment solutions, particularly for freelancers and businesses needing to receive payments from international clients. It also offered the ability to withdraw funds directly to a local bank account in multiple currencies.

Did TransferWise offer similar services to PayPal?

TransferWise, which is now known as Wise, was recognized for its transparent and low-cost international money transfer services. While not a direct PayPal competitor in all aspects, it provided a cost-efficient alternative for those focusing on international transactions with real exchange rates.

What kind of fees did Stripe charge compared to PayPal?

Both Stripe and PayPal charged a percentage of every transaction plus a fixed fee. However, Stripe’s fee structure was generally considered to be more favorable for businesses with larger transactions, due to its lower chargeback fees and no monthly fees.

Was Square available outside of the United States?

As of December 2024, Square was available in several countries outside the United States, including Canada, Japan, Australia, and the United Kingdom, offering a competitive alternative to PayPal for businesses in these regions.

Could Skrill be used for online shopping?

Yes, Skrill was not only for peer-to-peer transfers but also widely accepted by various online merchants, providing a secure way for customers to pay for goods and services online without sharing their financial details.

Could one use Payoneer to send money to friends or family?

While Payoneer was primarily designed for business transactions, it also provided the facility to send payments to other Payoneer users, which could include friends or family operating under a business account.

How did TransferWise keep their fees lower than PayPal?

TransferWise (Wise) minimized fees by using a peer-to-peer system that matched currency flows in different directions, avoiding traditional banking fees, and ensuring customers benefited from the mid-market exchange rate.

Was Stripe’s interface user-friendly for non-developers?

While Stripe was celebrated for its developer-friendly tools, it also offered a user-friendly dashboard that non-developers could navigate with ease for tracking payments, issuing refunds, and managing their business finances.

What additional services did Square offer businesses?

In addition to payment processing, Square provided businesses with additional services such as payroll management, customer engagement tools, and funding options to help grow their business operations.

Did Skrill require a merchant account like PayPal?

Skrill allowed users to receive money without the need for a traditional merchant account, simplifying the sign-up process. Users could also send direct transfers to bank accounts and emails, similar to PayPal’s model.

What was unique about Payoneer’s Global Payment Service?

Payoneer’s Global Payment Service gave users the ability to receive payments like a local bank transfer from companies worldwide, offering multi-currency receiving accounts which were an advantageous feature for international businesses.

Did Wise offer a debit card like PayPal?

Yes, at the time TransferWise (Wise) offered a debit card for users in certain regions, allowing them to spend money around the world with low conversion fees and free ATM withdrawals, up to certain limits.

Were there any sign-up fees associated with Stripe?

There were no sign-up fees or monthly fees required to start using Stripe. Businesses only paid for what they used, with transparent pricing on each transaction conducted.

How was Square’s user experience tailored for mobile use?

Square provided a highly optimized mobile experience, with its Square Reader and Square Stand accessories allowing businesses to turn mobile devices into powerful point-of-sale systems.

What type of security measures did Skrill take to protect its users?

Skrill employed robust security measures including two-factor authentication, encryption, and ongoing transaction monitoring to combat fraud and ensure user safety.

Could Payoneer be linked to e-commerce platforms?

Yes, Payoneer could be linked to popular e-commerce platforms and marketplaces, allowing sellers to easily receive funds from sales across diverse platforms.

Was it simple to set up an account on Wise?

Creating a Wise account was straightforward, as users could sign up online with minimal documentation and start transferring money right away, enjoying the platform’s straightforward fees and real exchange rates.